Call writers adding hefty OI

Resistance level remains strong, while support level declines by 700pts to 18,000PE

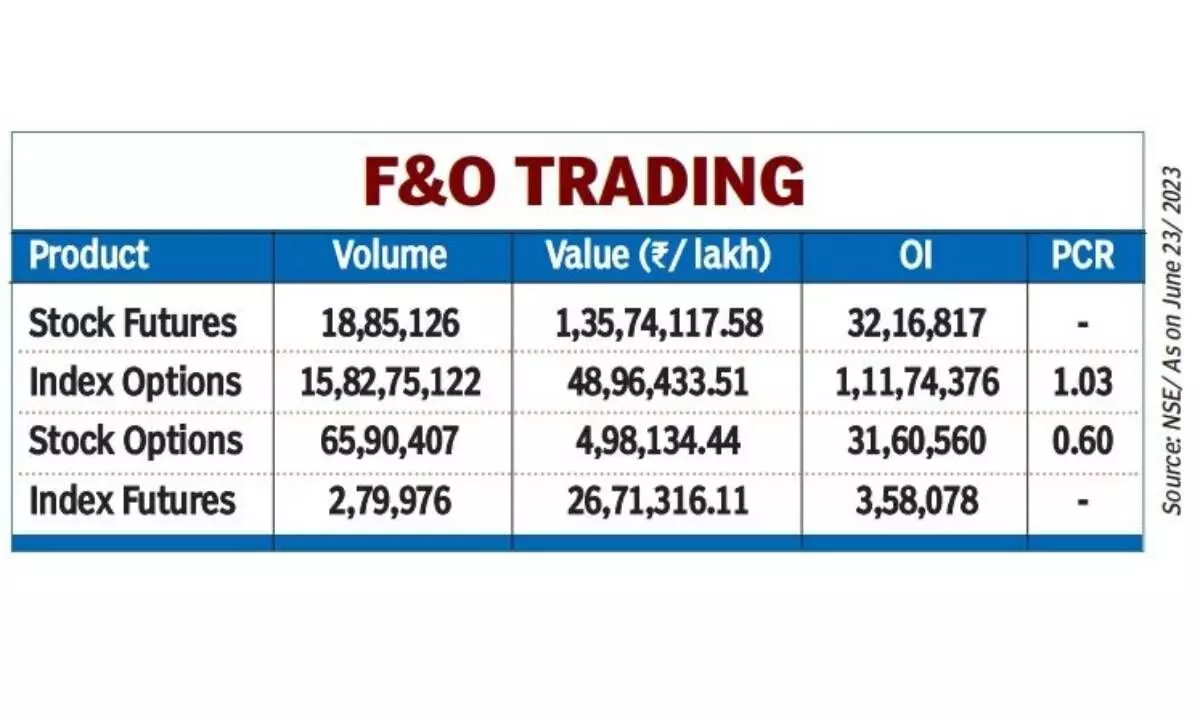

image for illustrative purpose

The options data on NSE after the last Friday session is pointing to strong resistance level and easing support level for the week ahead. The resistance level remained at 18,800CE for a second consecutive week, while the support level declined by 700 points to 18,000PE.

The 18,800CE has highest Call OI followed by 19,000/ 18,900/ 18,700/ 19,100/ 19,200/ 19,300/ 18,850/ 18,700 strikes, while 18,700/ 18,750/ 18,800/ 19,000/ 19,100 strikes recorded significant build-up of Call OI.

Coming to the Put side, maximum Put OI is seen at 18,000PE followed by 18,500/ 18,700/ 18,800/ 18,400/ 17,500/ 18,900/ 18,300 strikes. Further, 18,700/ 18,400/ 18,500/ 18,000/ 18,600 strikes witnessed reasonable addition of Put OI. Lower PCR stocks include Alkem Lab, Abbott India, Coromandel Intl, SRF Ltd, Infosys Ltd, Bharat Petroleum Corp, Atul Ltd, Oracle Financial, Navin Fluorine, Bosch, Dalmia Bharat, Hero MotoCorp.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “From the derivatives front, Call writers added hefty Open Interest at 18,800 strike, which now act as a strong hurdle for index moving forward.”

Aurobindo Pharma, JK Cement, Siemens, Cummins India, ABB Ltd, HDFC Life Insurance, Shriram Finance, Ultra Tech Cement, L&T Finance, Power Finance, Britannia Industries, etc., stocks have higher Put-Call Ratio (PCR).

Midcap Nifty, FinNifty, Bank Nifty, Airtel, Delta Corp, Nifty, HAL, Asian Paint, Voltas, BPCL, SBI Card stocks recorded spurt in OI.

“Throughout the past week, the Indian markets displayed significant volatility. The Bank Nifty closed the week in a negative zone, whereas Nifty also experienced selling pressure and settled with a loss of nearly one per cent. The Nifty index concluded the week above the crucial support level of 18,600 points, while the Bank Nifty once again struggled to hold 44,000 level. Notably, the pressure was seen coming from metal and realty counters, while mid-cap along with financials supported the markets,” added Bisht.

BSE Sensex closed the week ended June 23, 2023, at 62,979.37 points, a net loss of 405.21 points or 0.63 per cent, from the previous week’s (June 16) closing of 63,384.58 points. During the week, NSE Nifty fell by 160.50 points or 0.85 per cent to18,665.50 points from 18,826 points a week ago.

Bisht forecasts: “Technically Nifty has given a channel breakdown which points towards further downside in index on back of profit booking. On the downside now, 1600 would act as strong support levels below which Nifty is expected to slide further towards 18500 levels. Traders are advised to adapt the wait n watch strategy as of now, and keep focus on sector specific and stock specific moves.”

“The Implied Volatility for Call options concluded at 10.89 per cent, while Put options closed at 11.79 per cent. The Nifty VIX, which measures market volatility, ended the week at 11.55 per cent. The PCR of OI settled at 0.99 for the week less than previous week indicates more Call writing,” remarked Bisht.

As the markets enter a new week, traders see lack of clear cues. However, the expiration of June’s F&O contracts may introduce some volatility as traders roll over their positions.

Bank Nifty

NSE’s banking index closed the week at 43,622.90 points, a fall of 315.25 points or 0.71 per cent from the previous week’s closing of 43,938.15 points. Bank Nifty PCR is 0.843 level.